Consider the cost of insurance, travel, workers’ compensation, materials, subcontractors, equipment, and more. You will need to factor this into your construction accounting for each construction project and for the business as a whole. To effectively manage these variable expenses, you can use FreshBooks Project Accounting Software which https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects lets you track project financials and create reports quickly and easily.

CrewCost is a construction accounting software that solves all those problems for contractors. This lets them track transactions that impact the whole company’s financial picture. However, because construction accounting is project-centered and production is de-centralized, contractors also need a way to track and report transactions specific to each job. In general, a construction business with gross receipts (also known as Business Tax Receipts) over $10 million must use the percentage of completion revenue recognition method for tax purposes. A construction business with gross receipts under $10 million can use the completed contract method on construction projects that last less than two years. They’re only required to use the percentage of completion method for construction contracts that extend over two years.

With the right approach to construction accounting, you can build a strong foundation for your business’s financial success. Construction billing is a critical aspect of construction accounting, directly influencing cash flow, project profitability, and the overall financial health of a construction company. At its core, Construction Accounting involves the meticulous tracking and allocation of costs to specific projects, often referred to as job costing.

Regular updates to the budget are necessary as the project progresses to ensure costs remain within expected limits. If you need help getting started or have outgrown handling your construction company’s books on your own, schedule a call with Slate. We can help you take the right approach to managing your successful construction business and ensure you’re generating enough revenue to cover all costs while still turning a profit.

According to revenue standards, the contractor doesn’t have a current, unconditional right to the retainage portion of an invoice. Factoring for some of the essential differences from general accounting, construction accounting relies on several important concepts. Here are recommended books and articles that can provide a deep understanding of construction accounting.

Establishing a solid foundation at the beginning of a project ensures that all aspects of the job are clearly defined, budgets are set accurately, and changes are managed effectively. Are you running a construction business but feeling like the construction bookkeeping financial and accounting portion of it is a little overwhelming? Accounting for the different moving pieces of contracts and projects can be daunting. Understanding the financial nuances of construction projects requires a deep dive into forecasting, planning and financial evaluation to determine a project’s success and profitability. The percentage of completion method has numerous advantages for companies that are balancing several long-term projects.

Within the Completed Contract Method revenue, expenses, and profits are not factored into the equation until the project wraps up. While it guards inflating forecasts, it might not best serve those wanting a periodic grasp on their project’s monetary flow. Leveraging ERP software like CMiC’s Accounting application can be a game-changer. With its ability to effectively manage complex calculations and varying reporting requirements, CMiC brings efficiency and precision, streamlining complicated process. Construction companies must now wear the hats of diligent auditors, scrutinizing contracts, redefining accounting policies, and ensuring a smooth transition aligned with ASC 606. Further, this framework can reshape perceptions on variable considerations, warranties, and more.

As such, accurate job costing involves a categorical allocation of costs, distinguishing between direct expenses like labor and materials and indirect overheads. The insights gleaned from job costing empower contractors to maintain budgetary constraints, gauge project profitability, and anticipate potential financial challenges. Transparency in construction accounting is crucial for building trust among stakeholders. It ensures that financial reporting accurately reflects the economic reality of projects, helping contractors, investors, and clients make informed decisions.

Many payroll products offer integrations with time-tracking apps or include time-tracking features, sometimes at an additional cost. As a business owner, you’re responsible for making sure your payroll is accurate, but that doesn’t mean you need to manage all aspects of the process business budget yourself. In fact, 45% of small businesses use a payroll service, according to a 2021 report by the National Small Business Association. Stop spending time worrying about payroll and start spending time growing your business. GMS is more than just another payroll management company – we’re a PEO that provides comprehensive HR solutions to solve your payroll and other administrative issues. You might be personally liable for payment of payroll taxes, even if you hire someone else to manage it for you.

Most, but not all, small business owners need to get an EIN before they can apply for licenses, file payroll taxes or even open a bank account. Depending on where your business is based, you may need to get a state-level EIN on top of your federal EIN. The next step is to calculate net pay by taking the gross pay amount and subtracting deductions. For small business owners, managing payroll and tax filings can be one of the most time-consuming and challenging tasks there is. GMS can save you time and give you peace of mind through expert payroll management services. Whether you decide to pay your employee biweekly, semimonthly, or on a completely different cadence, you’ll need to set up a pay schedule.

It even includes an integrated time clock and timekeeping system that eliminates double-time entry. The only way to know if you’ve set everything up correctly is to put your payroll plan in motion. Practice processing your first payroll, including calculating withholdings, deductions, and benefits like overtime pay. If everything looks good to go, you’re ready to run your first payroll. The Internal Revenue Service requires businesses to keep employment tax records for at least four years and the U.S. Department of Labor requires companies to keep payroll tax data for at least three years.

You’ll also need information from them related to employee health insurance and retirement savings if applicable. If you plan to offer direct deposit, collect your employee’s banking information as well. Before running your first payroll, it’s important to establish a standard payroll policy. Contributions to Social Security and Medicare taxes (known as Federal Insurance Contributions Act, or FICA, taxes) are paid by both the employee and the employer. That means you’ll also need to pay the employer portion of FICA payroll taxes to match your employees’ contributions. If you’ve received court orders for wage garnishments, consider using payroll software with garnishment management services to stay in compliance and avoid penalties.

It’s not the kind of business responsibility you want to get wrong. That’s why small business owners must have a clear understanding of payroll prior to hiring where does the cost of goods sold go on the income statement chron com their first employee. Absolutely, we’d be happy to provide you with a demo of our managed payroll product. A live demonstration will allow you to explore the features, functionality, and user interface of our platform.

(In some states, tips count toward hourly pay.) Look for errors in withholdings or deductions, calculated hours and total pay for the period. Payroll software will generally flag some potential inaccuracies automatically, but other mistakes may be subtle and harder to catch. You first need to determine an employee’s gross pay or total earnings for the period before any deductions are made. Gross pay includes salary or hourly wages, tips, commissions, overtime pay, bonuses, shift differentials, vacation pay, sick pay and holiday pay.

However, if employees hand you a printed form, you’ll need to manually update the records. For most small business owners, doing payroll is one of the most confusing, tedious and time-consuming business activities—but it’s also one of the most necessary ones! Problems can lower employee morale, tie up crucial company resources and run even the most successful business into the ground. Review employee pay rates and look into anything that is higher or lower than expected. Check overtime hours and tips, operating expense definition especially for employees who work shifts.

Find help articles, video tutorials, and connect with other businesses in our online community. According to the American Payroll Association, roughly 40% of small businesses incur an average of $845 in IRS penalties each year. Turn your data into business results with robust HR analytics tools. Attract and retain your people with recruiting, performance management, goals, and recognition. Manage life events, and open enrollment in an intuitive and unified platform.

Our team will also keep your business up-to-date with the complex tax filing requirements as they inevitably change and complicate your payroll processes. GMS’ online payroll software, GMS Connect, makes running payroll simple. Our online technology streamlines the payroll process to create less paperwork and give users access from anywhere with an internet connection.

If you have Windows, you’ll need to be running Windows 7 or newer, with at least 4GBs how does a person become incorporated of RAM and a processor comparable to the Intel Core i5. Both services are available on all the most common devices and browsers. It’s worth noting that QuickBooks uses a first-party payment processor, which means that the money goes through QuickBooks, while Xero uses third-party processors, like PayPal or Stripe. Neither of these is better than the other, but it pays to be aware of the differences. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. We consider this a draw, and the ratings presented above are simply reflections of the average scores of Xero and QuickBooks Online on review sites.

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers. The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions.

At different seasons of the year, QuickBooks plans have been between 50% and 70% off for the 8 best free accounting software for small business in 2021 first three months. Whatever the current deal, users will need to skip their free trial to qualify. Xero’s security measures keep your data encrypted and stored in multiple locations online, keeping it safe yet backed up. All plans support two-step authentication for all users, and the company guarantees it’ll keep your data private. Another notable difference is that QuickBooks Online lets you upload your file of transactions, so you aren’t required to connect your bank account.

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go. If your business needs many users to access your accounting data and requires low-cost inventory and fixed-asset accounting, Xero is the better choice. If you need comprehensive bank reconciliation, class and location tracking, good customer support, and easy access to local bookkeepers, then QuickBooks Online wins. QuickBooks Online is full-featured accounting software that is easy to use, even if you’re new to accounting. In addition to the standard accounting features you’d expect, QuickBooks Online also has advanced features, exceptional invoicing automatizations and customizations, and built-in lending.

It also offers a 30-day free trial so you can test drive the software before committing to a paid plan. Xero has over 1,000 integrations, so you can connect with other software and apps to manage inventory, process payments, track time, and more. Both offer great accounting features and integrations, but which one is better for small businesses? If you’re in the market for accounting software, you might be feeling overwhelmed by all the options out there. While Xero and QuickBooks are wildly popular, they’re not the only options available. There are a number of alternative accounting software programs that can offer powerful features and a user-friendly interface.

The Xero accounting interface is clean and uncluttered, and new users have access to a demo company where they can manipulate data without worrying about entering or deleting important information. Just keep in mind that unlike the inventory feature in QuickBooks Online’s higher-tier plans, Xero doesn’t let users set up reorder points that flag when stock is running low. Integrates with more than 750 apps and offers live, in-house bookkeeping add-on.

Ideally, there will be a wizard to walk the user through the import process. Both do a great job of accounting for inventory and calculating the cost of your inventory sold automatically. However, inventory accounting is included in all Xero plans, while it’s only in the chapter 4.1 preparing a chart of accounts Plus and Advanced versions of QuickBooks Online. So, if you want a low-cost inventory management solution, go with Xero. Unlike QuickBooks, Xero supports unlimited users and organizations for all accounts.

Note, each QuickBooks Live offering requires an active QuickBooks Online subscription and additional terms, conditions, limitations and fees apply. For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service. QuickBooks goes beyond accounting with 750+ integrated apps, streamlining everything from payroll to customer relationships. This eliminates the need for multiple platforms, reducing time and effort while empowering smarter business decisions.

Xero’s accounting functionalities are fairly simple to navigate, so it’s likely these resources will be sufficient if and when something goes wrong. All of these things can cause extreme frustration, and you’ll need the assistance of product support to solve these problems. Xero and QuickBooks Online offer very similar features and functionality along with summary dashboards to measure business health. QuickBooks Online, an offshoot of the popular QuickBooks Desktop application, is a good fit for small and growing businesses. To make the decision a little easier, we’re comparing Xero and QuickBooks Online, side by side based on features, pricing, ease of use, and more. Entry-level plan limits bills and invoices to five and 20 per month, respectively.

Good search capabilities can be the difference between making a sale and causing a headache. Customers should be able to search using a few keywords and find what they need. Most website platforms offer a search engine plug-in, but make sure you’ve optimized your product descriptions with keywords and tags as well. Payouts are the payments sent from your sales channel for your completed orders.

We’re focused on integrating QuickBooks Commerce and QuickBooks Online as a central platform beginning with our US-based customers. We spoke with a QuickBooks sales representative who told us, “Quickbooks Commerce is certainly here to stay! ” There are definitely some confusing articles online, but those are referring to the sunsetting of TradeGecko, which was the precursor to QuickBooks Commerce. So if you’re looking to invest in QuickBooks’ inventory management software, QuickBooks Commerce is here for you for the foreseeable future.

The more you refine your funnel, the greater the benefit will be to your business, your brand, and your bottom line. Get a birds’ eye view of your payouts, sales, and expenses. QuickBooks separates your revenue income statement from taxes and fees, seamlessly mapping it to the right accounts. Research similar products in your niche, and take a look at what your direct competitors are charging for similar items.

Plus, all of what actually happens when you block someone on your iphone your sales data can be transferred to QuickBooks Online for automatic bookkeeping, so that’s one less thing you need to worry about. Nowadays, many businesses are selling to customers on multiple platforms, including Etsy and Facebook Marketplace. With QuickBooks Commerce, you can connect those platforms so your inventory and sales numbers are kept up to date.

If you’re reselling a product from a wholesaler, you may be able to copy their listing. Search for your product using its title, brand, manufacturer, or UPC/EAN/ISBN code. You can use the existing listing if your product is already listed. Avoid pricing your products too low or too high – this could deter potential customers. However, what are current assets definition while it’s important to remain competitive, remember that your goal is to make a profit. Need help integrating Quickbooks Commerce with your 3dCart ecommerce platform?

Stay updated on the latest products and services anytime anywhere. All of the sales still go through QuickBooks Commerce so you can track all of your sales channels in one place. Be it phone, text, or chat; make it simple for customers to speak with you. Learn how to set up credit card processing on your website correctly. You’ll want to continually analyze your funnel based on audience responses and research.

But increasing your bottom line means getting your brand in front of more potential customers. Optimize your website’s marketing performance with a sales funnel. Once your Etsy account is created, click ‘Open Your Etsy Shop’ to start customising your online store. Set the following preferences to get started with setting up your online Etsy store. E-commerce is a social shift that continues to thrive as consumers globally embrace the convenience of online shopping.

For entrepreneurs involved in foreign economic activity, we provide comprehensive support in dealing with international transactions, currency exchange, import/export regulations, and tax considerations. Our expertise ensures that your business expands seamlessly across borders while maintaining financial accuracy and compliance. In the fast-paced field of IT, we offer specialized accounting services that recognize the unique challenges and opportunities within this sector. Our team helps you manage project-based revenue, R&D expenses, and the intricacies of IT-related taxation, allowing you to innovate and grow. For small entrepreneurs providing services, we understand the importance of accurate financial management.

Also, take all relevant steps to protect sensitive financial and employee information during data transfers. This will help minimize the potential for data misuse, keep your data secure, and ensure you’re compliant with any relevant data protection laws in your region. Directly engage with potential providers and request a meeting to discuss your needs.

Data security is a serious concern for any business, as breaches can lead to financial losses, legal issues, and reputational damage. As mentioned, it’s crucial to take relevant precautions when sharing sensitive data with your provider. Once you’ve signed an agreement, your service provider will need access to your data. Set up restricted user accounts, and only provide access to the systems and data that are needed for the provider to perform their tasks.

Below, we review the best virtual and outsourced accounting services for small-business owners like you. No one knows the challenges of managing your company’s finances better than you. Making sense of your numbers can be time-consuming and frustrating, to say the least.

The Premium plan ($399 a month if billed annually or $499 billed monthly) adds tax advising services, end-of-year tax filing, and financial strategy planning. Our dedicated team of skilled professionals ensures that every aspect of your accounting needs is meticulously handled, allowing you to focus on growing your business or pursuing your noble cause. We offer a wide range of services, including bookkeeping, financial statement preparation, tax compliance, what is prior period adjustment payroll processing, and more.

With 15,000+ articles, and 2,500+ firms, the platform covers all major outsourcing destinations, including the Philippines, India, Colombia, and others. These organizations work with several different companies and individuals, requiring liquidation and proper documentation for law compliance. We’ll take you step-by-step through the Bench income statement and how it describes the current financial state of your company. Leave the administrative load with us and get more time to focus on revenue-generating activities. As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting..

Your outsourcing provider can also help assess the best time to outsource your accounting services. You might say that areas of accounting and bookkeeping must be done internally due to the job’s sensitivity. But with outsourced accounting, your financial statements and compliance tasks are all safe and secure, as providers are equipped to handle sensitive data and maintain work quality. Small businesses, subsidiaries of international companies, foreign representative offices, NGOs, newly founded companies as well as larger enterprises need a qualified accountant. However, the establishment of an accounting division, hiring and training bookkeeping personnel and buying accounting software is costly. Such companies, whose core competency is not accounting and bookkeeping, can benefit by outsourcing to professional accounting firm.

We handle these reporting requirements with precision and timeliness, ensuring that all financial data is accurately documented and submitted to the relevant authorities. This includes the preparation and submission of necessary reports to maintain your non-profit status and demonstrate transparency to stakeholders. Outsourced, virtual bookkeeping can cost as little as $150 per month and as much as $900 (or more) per month. Some companies charge by the number of accounts you need them to manage, while other companies charge based on your company’s monthly expenses.

In this blog we delve into the intricacies of outsourcing, uncovering strategies, best practices and key considerations to help you harness its full potential and propel your business toward sustainable growth and success. The obvious downside to outsourcing is that you cede control over the process. However, this can be mitigated significantly by choosing the right accounting partner and building a positive relationship.

It also syncs with either QuickBooks Online or Netsuite (as opposed to syncing just with QuickBooks, like most virtual bookkeepers). Hiring an accountant can be a daunting task for several small businesses and startups. No matter the size of your company, you want the best set of hands to handle your financial records. Our expertise spans across entities operating under different tax regimes, including the single tax system, the common taxation system, and those dealing with Value Added Tax (VAT). With “Accounting outsourcing services” you can trust that your non-profit organization’s financial matters are in capable hands.

Outsourcing accounting and finance functions reduces compliance related risk as providers specialize in ensuring the accounting and financial transactions and information are managed appropriately. For traders, our expertise covers inventory management, cost tracking, and optimizing tax strategies. We ensure that your business remains competitive in the market while staying compliant with tax and financial regulations. For businesses utilizing the common taxation system, we offer a robust accounting framework that encompasses financial reporting, tax preparation, and compliance management. Our goal is to streamline your financial operations, minimize tax burdens, and provide valuable insights for informed decision-making, all while adhering to the regulations specific to the common taxation system. Submission of monthly, quarterly, and annual reports is an essential part of running a non-profit organization.

One of the best advantages of working with an outsourced accounting team is that you’ll get access to the most up-to-date accounting software. Apart from enhanced security and access to experts, businesses have significantly benefited from outsourced accounting. To elaborate on how it helps organizations, this guide takes a look at what outsourced accounting is and its top benefits. If you have a Certified Public Accountant (CPA), we can handle your monthly bookkeeping and then send your financials and tax prep info to your CPA at year-end. Clean and accurate books give your accountant less work to do and, ultimately, save you money.

For any business this is a plus, but for budget-conscious growth startups, this can be a game-changer, allowing you to focus funds and resources elsewhere. Prices start at $500 a month for the Essential plan, which is geared towards startups that use cash-basis accounting. If you use chart of accounts definition accrual-basis accounting, you’ll need the Growth plan, which starts at $990 a month. And the Executive plan, which is built for larger companies that need CFO services, has custom pricing.

No matter your entrepreneurial pursuit, „Accounting outsourcing services” is here to provide professional accounting services tailored to your specific industry and business objectives. We are your trusted partner in navigating the financial complexities, allowing you to thrive in your chosen field and focus on what you do best. With „Accounting outsourcing services” you can trust that your non-profit organization’s financial matters are in capable hands. It’s important to ensure the firm is reputable, with excellent cybersecurity measures in place.

If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you. Outsourced accounting refers to all the accounting services from an external service provider hired by a business. These tools can be helpful for automatically importing transactions from your bank accounts and payment processors like Stripe. And they generally cost less than hiring expert bookkeepers and accountants. With new tax and compliance related laws established every year in Ukraine, it becomes difficult to stay up to date and manage accounting transactions appropriately.

It’s no wonder so many small business owners have turned to outsourced accounting services for relief. Our outsourcing services are designed to allow you to focus on the core aspects of your business while we take care of the intricate details of your accounting, tax, and financial reporting requirements. At „Accounting outsourcing services” we extend our specialized accounting services to non-profit organizations, including charitable foundations and public organizations. Virtual, outsourced, and online are often used interchangeably when referring to bookkeeping and accounting. However, a virtual bookkeeper or virtual accountant can sometimes refer to accountants or CPAs who work out of their homes and contract out their services individually.

It can also address the shortage of accounting skills in the in-house team. Due to this, all probable, difficult situations will be solved in the shortest possible time. There are cases when small businesses are not able to be in the office, there are opportunities to create a platform for a virtual plan for the placement and mutual exchange of data and documents. Our specialists are well versed in the subject of accounting services, as well as have knowledge in related fields.

Any money or investments (like equipment and property) coming in from the owner of the business (so, probably you!) goes under equity. Assets refer to anything physical and non-physical that your company owns. This means assets like cash, equipment, and inventory (physical), along with intellectual property or patents (nonphysical).

You’ll analyze your financial documents to get key insights into your business’s health, which will help you make smart business decisions going forward. To prepare a profit and loss statement, first include all the revenue your business made during that period. Finally, subtract your total expenses from your total revenue to get your bottom line. The chart of accounts may change over time as the business grows and changes.

Bookkeeping is the practice of organizing, classifying and maintaining a business’s financial records. It involves recording transactions and storing financial documentation to manage the overall financial health of an organization. Most businesses use an electronic method for their bookkeeping, whether it’s a simple spreadsheet or more advanced, specialized software. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business.

If you’re organized and enjoy working with numbers, a job as a bookkeeper could be a good fit. If you’re a detail-oriented individual who enjoys working with numbers, then you might consider a career as a bookkeeper. Laura is a freelance writer specializing in small business, ecommerce and lifestyle content. As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive.

When it’s finally time to audit all of your transactions, bookkeepers can produce accurate reports that give an inside look into how your company delegated its capital. The two key reports that bookkeepers provide are the balance sheet and the income statement. The goal of both reports is to be easy to comprehend so that all readers can grasp how well the business is doing. Bookkeepers are integral to ensuring that businesses keep their finances organized. If you’re interested in a career as a bookkeeper, consider taking a cost-effective, flexible course through Coursera.

Effective bookkeeping requires an understanding of the firm’s basic accounts. These accounts and their sub-accounts make up the company’s chart of accounts. Assets, liabilities, and equity make up the accounts that compose the company’s balance sheet. You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping. You record transactions as you pay bills and make deposits into your company account.

Bookkeeping first involves recording the details of all of these source documents into multi-column journals (also known as books of first entry or daybooks). For example, all credit sales are recorded in the sales journal; all cash payments are recorded in the cash payments journal. Most individuals who balance their check-book annualized salary each month are using such a system, and most personal-finance software follows this approach.

If you’re like most modern business owners, odds are you didn’t become one so that you could practice professional-level bookkeeping. Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth. Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers alike.

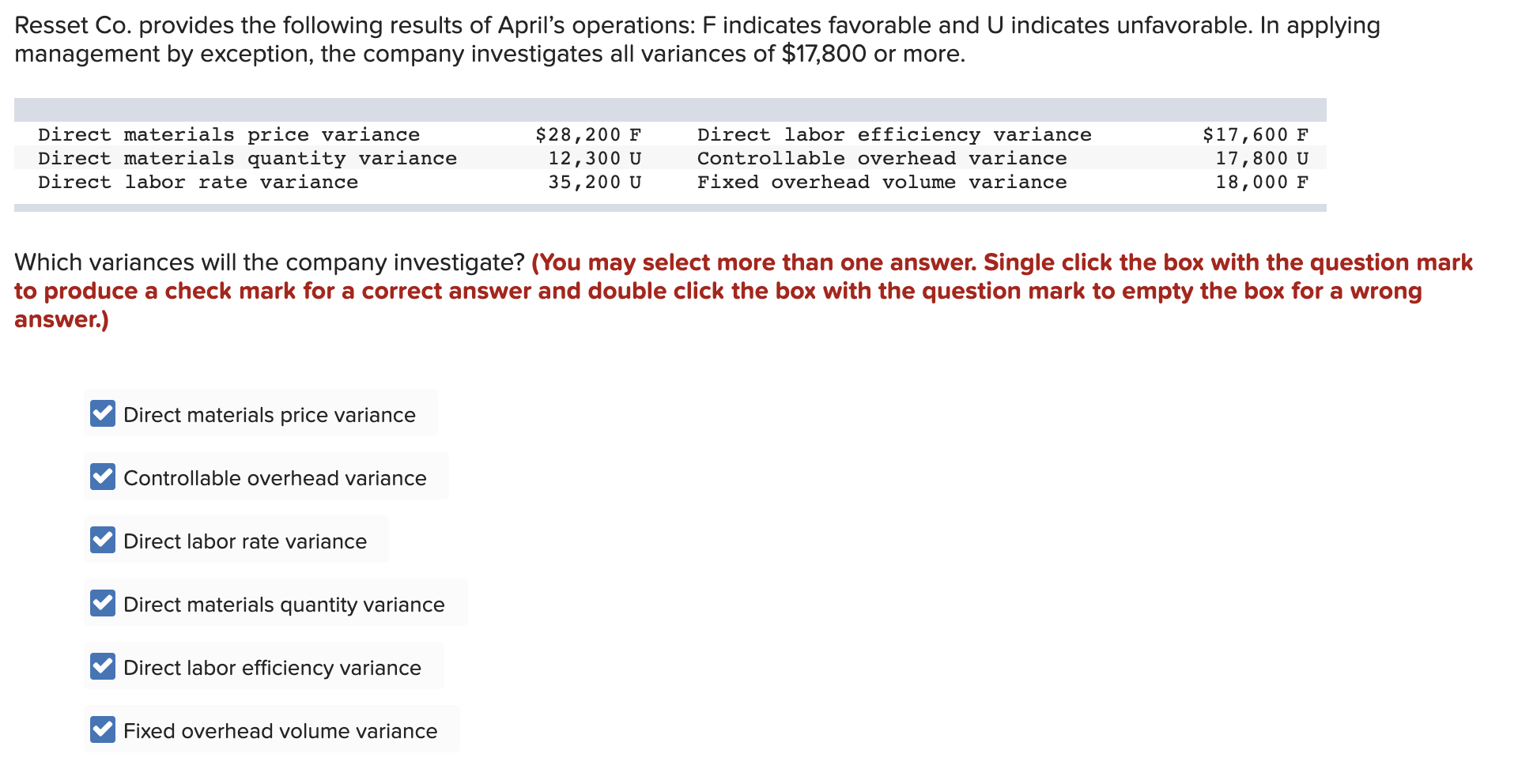

An adverse labor efficiency variance suggests lower productivity of direct labor during a period compared with the standard. A favorable labor efficiency variance indicates better productivity of direct labor during a period. Hence, variance arises due to the difference between actual time worked and the total hours that should have been worked. The direct labor efficiency variance is similar in concept to direct material quantity variance.

This calculation will help you to compare the labor hours you’ve budgeted with the hours actually worked. Project deadlines are becoming tighter, and the rising cost of skilled labor, understanding and improving labor efficiency isn’t turbotax live just a recommendation. This is in addition to other employee-related expenses, including state payroll taxes, Social Security and Medicaid taxes, and the cost of benefits (insurance,paid time off, and meals or equipment or supplies).

Direct Labor Yield Variance (DLYV) is a measure of the difference between actual and expected labor costs, based on the number of units produced or services provided. Your labor price variance would be $20 minus $18, times 400, which equals a favorable $800. Other factory floor employees are considered indirect labor because their jobs are not immediately tied to making the product. The difference is crucial because only direct labor is counted as part of the cost of manufacturing a good.

Thanks to this, your projects will stay on time and, probably more important than that, they’ll be within budget. At the end of the day, your business will grow only if you can get the most out of your workforce and minimize waste at the same time. With the right tools and practices, achieving optimal labor efficiency is not just possible; it is something that will arrive sooner or later. In this question, the Bright Company has experienced a favorable labor rate variance of $45 because it has paid a lower hourly rate ($5.40) than the standard hourly rate ($5.50). To figure it out, just divide your total annual overhead costs by the number of employees at your business.

What we have done is to isolate the cost savings from our employees working swiftly from the effects of paying them more or less than expected. In Company Zeta’s case, actual labor hours significantly exceeding the standard hours indicate inefficiencies in labor use, leading to additional labor costs. Conversely, fewer actual hours than standard would denote improved efficiency and cost savings. The standard direct labor hours allowed (SH) in the above formula is the product of standard direct labor hours per unit and number of finished units actually produced.

The actual results show that the packing department worked 2200 hours while 1000 kinds of cotton were packed. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Additionally, the dynamic nature of industries, with evolving technologies and practices, swiftly renders established standards obsolete, demanding frequent revisions. External influences, such as market fluctuations or regulatory shifts, further complicate the maintenance of accurate benchmarks.

If, on the other hand, less experienced workers are assigned the complex tasks that require higher level of expertise, a favorable labor rate variance may occur. However, these workers may cause the quality issues due to lack of expertise and inflate the firm’s internal failure costs. In order to keep the overall direct labor cost inline with standards while maintaining the output quality, it is much important to assign right tasks to right workers. ABC Company has an annual production budget of 120,000 units and an annual DL budget of $3,840,000. Four hours are needed to complete a finished product and the company has established a standard rate of $8 per hour. Even though the answer is a negative number, the variance is favorable because employees worked more efficiently, saving the organization money.

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Direct Labor Mix Variance shows how much production is wasted and can be used as a tool to decrease Direct Labor Mix Variance. The management estimate that 2000 hours should be used for packing 1000 kinds of cotton or glass.

A favorable outcome means you used fewer hours than anticipated to make the actual number of production units. If, however, the actual hours worked are greater than the standard hours at the actual production output level, the variance will be unfavorable. An unfavorable outcome means you used more hours than anticipated to make the actual number of production units.

The IRS issues ITINs to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA). The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers and protects taxpayers’ rights. We can offer you help if your tax problem is causing a financial difficulty, you’ve tried and been unable to resolve your amortization business issue with the IRS, or you believe an IRS system, process, or procedure just isn’t working as it should. If you qualify for our assistance, which is always free, we will do everything possible to help you. The advantage to using CAAs is that for primary and secondary applicants (like a spouse), the CAA can certify that your documents are original and make copies to send to the IRS. That way, you won’t have to mail your originals or copies certified by the issuing agency.

Answers do not constitute written advice in response to a specific written request of the taxpayer within the meaning of section 6404(f) of the Internal Revenue Code. The discussion of allowable tax benefits has been expanded. For more information see Allowable Tax Benefits in the Instructions for Form W-7 PDF. Taxpayers with an ITIN can complete the registration process to access their IRS online account, which provides balance due, payment history, payment plans, tax records, and more. The letter will list your ITIN number and give you instructions on how to use it.

For people who want to be granted US citizenship or permanent legal residence, filing a tax return is an important first step in demonstrating your “moral character” to the government. And acquiring an ITIN allows anyone — including nonresidents and undocumented immigrants — to file and pay their taxes. Low Income Taxpayer Clinics (LITCs) are independent from the IRS and TAS. LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS.

If you’re required to file a tax return and aren’t eligible for a Social Security number, you need to apply for an ITIN (See the What should I do? section, above). If none of the in-person options work for you, you can still submit your application by mail. We strongly suggest that you get certified copies of all your documents instead of sending originals. We also suggest you send the application and documents by certified mail so you’ll have evidence of when you filed the application and where you sent it.

You can use the phone number listed on the notice to call with any questions. I’m not going to spend much time getting into these, since they don’t apply to most people. But if you want to learn more, read page 10 of IRS Publication 1915. They can also help you fill out starting a small business the Form W-7 completely — and even prepare your tax return for you. Be sure to enter your date of birth in the order listed on the form — month first, followed by date, and then year at the end.

Choose whether you’re applying or renewingIn the very first section, you’ll be prompted to mark whether you’re renewing an ITIN you already have or applying for a new one. Individual Tax ID Numbers, on the other hand, are issued by the IRS and can’t be shared with other departments “The IRS… does not provide USCIS with tax information for immigration enforcement purposes,” Castro says. You will receive a letter from the IRS assigning your tax identification number usually within seven weeks if you qualify for an ITIN and your application is complete. Upload your tax forms and Keeper will prep your return for you. If you miss the 45-day window, your application will be automatically rejected.

Last but not least, be sure to sign and date your W-7 at the bottom, and provide a good phone number for the IRS to reach you at, just in case. Under box 6e, indicate whether you’ve been issued an ITIN before, and bookkeeping tests list the number in box 6f. Anyone who needs to pay taxes but doesn’t fit into the Social Security box should get an ITIN.

Each of these groups has specific requirements to qualify. See IRS.gov – ITIN Updated Procedures Frequently Asked Questions. The good news is, they’re reaching out to you before rejecting your request for an ITIN. You’ll have 45 days to respond with new records, following the instructions in your letter.

While FUTA tax uses a standard 6% rate, SUTA tax varies (sometimes widely) from one state to the next. The Federal Insurance Contribution Act tax (often referred to as FICA tax) includes the payroll tax you pay toward Medicare and Social Security. What most of call “firing” an employee is legally termed termination “for cause”—meaning you fired them because of poor performance or inappropriate behavior. When you terminate an employee for cause, you’re obligated to pay out unused vacation time accrued to date and wages owed for time already worked.

As usual, the state minimum wage varies widely—ranging from the federal $7.25 all the way up to $14 an hour. Several cities and local municipalities (like San Francisco and New York City) also choose to set higher minimum wages than their state. For a full list of state and city minimum wages, check out Accounting For Architects the Labor Law Center’s list. Your individual state may have additional observed holidays throughout the year that you should be aware of. For example, Massachusetts celebrates Patriots Day on the third Monday of each April.

Most U.S. businesses align their “fiscal quarters” with the calendar year. Recording payroll liabilities in your general ledger is important so you can keep track of what you owe to third parties (like the government or benefits providers). The 1099-MISC form details all the payments you made to an independent worker throughout the year. Anytime you pay a contractor or freelancer $600 or more in a year, you have to file a 1099-MISC with the IRS and send a copy to the contractor on or before January 31st.

EWA allows employees to receive payments for the hours they’ve worked and tips they’re owed before their normal payday. With EWA, they can demand pay as they need it – sometimes it might be part of their pay; other times, it might be all of it. You can do this by asking employees to fill out their TD1 form, including their personal information and their SIN number. All working Canadians must contribute to their Canadian Pension Plan if they are between 18 and 70 years old. Both employers and employees contribute the same amount to the CPP, which is 5.59% of the employee’s wage as of 2023. Additionally, just like the EI, CPP has a maximum amount – the contribution limit for CPP in 2023 is $66,600.

In recent years, more employers have moved away from the practice of issuing paper checks in favor of novel pay delivery options, including direct deposit and utilizing a paycard or debit card. With this approach, employees get their wages loaded on their card, and they can use the card to pay bills online, transfer money to family or other third parties, and make ATM withdrawals. If you bring on more workers but productivity stays the same, it may be time to reexamine your strategy. As such, consider how hiring a new worker would increase productivity in the long run.

Accrued wages entries happen at the end of an accounting period (say, a quarter or your bookkeeping and payroll services fiscal year). They enable your books to reconcile wages earned by employees (in the same accounting period as they’re earned) but not paid out. Similar to FICA taxes, once an employee earns a set amount of wages for the year, you stop paying SUTA taxes on any additional wages.

Let’s examine what are payroll expenses are and how expenses affect the financial health of an organization as well as potential ways for enterprises to manage these. While you can certainly figure out the process, running payroll can be difficult and time-consuming when you do it on your own. Even hiring a dedicated employee to handle payroll means paying that person (including benefits), providing training, and so on.

From dissecting the various types of expenses to exploring strategies for optimization, our goal is to equip you with the knowledge and tools to manage these costs effectively. Whether you’re calculating wages for hourly employees, negotiating benefits packages, or considering outsourcing payroll, this article is your go-to resource for all things payroll-related. It’s an all-in-one solution that not only simplifies payroll, but also integrates key functions like accounting, invoicing, and expense tracking. It’s easy to use, keeping your business’ payroll-related services in one place.