In contrast, plant assets represent long-term property expected to be around for at least a year, often quite a bit longer than that. The accountant debits the entire costs to Land, including the cost of removing the building less any cash received from the sale of salvaged items while the land is being readied for use. Land is considered to have an unlimited life and is what are plant assets therefore not depreciable.

Investment analysts and accountants use PP&E to determine if a company is financially sound. Purchases often signal that management expects long-term profitability of its company. Industries or businesses that require extensive fixed assets like PP&E are described as capital intensive. Depreciation allocates the cost of a tangible asset over its useful life and accounts for declines in value.

Plant assets must also be reviewed for impairment at regular intervals. This classification is rarely used, having been superseded by such other asset classifications as Buildings and Equipment.

These assets are significant for any business entity because they’re necessary for running operations. Besides, there is a heavy investment involved to acquire the plant assets for any business entity. The company’s top management regularly monitors the plant assets to assess any deviations, discrepancies, or control requirements to avoid misuse of the plant assets and increase the utility. The assets can be further categorized as tangible, intangible, current, and non-current assets.

Even if the market value of the asset changes over time, accountants continue to report the acquisition cost in the asset account in subsequent periods. Land, as a fixed asset, is classified as a long-term, tangible https://www.bookstime.com/ asset. Plant assets are a group of assets used in an industrial process, such as a foundry, factory, or workshop.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Explore essential strategies for effective battery storage infrastructure planning and sustainability. Someone on our team will connect CARES Act you with a financial professional in our network holding the correct designation and expertise.

The amount of a long-term asset’s cost that has been allocated to Depreciation Expense since the time that the asset was acquired. Accumulated Depreciation is a long-term contra asset account (an asset account with a credit balance) that is reported on the balance sheet under the heading Property, Plant, and Equipment. Land refers to the land used in the business, such as the land on which the production facilities, warehouses, and office buildings were (or will be) constructed. The cost of the land is recorded and reported separately from the cost of buildings since the cost of the land is not depreciated. The purchase and sale of plant assets would affect a company’s cash flow.

These professionals will easily incorporate the essential infrastructure into your organisation, giving you the scalability and automation that your company requires. Furthermore, outsourcing to an accounting firm allows you to work with a team of financial experts. You may rest assured that your accounting is in the hands of a reliable and knowledgeable business if you choose an outsourcing provider wisely. When paying employees’ salaries on an hourly or Bookkeeping for Any Business Industry monthly wage, you must consider recruiting, onboarding, employee benefits, and insurance.

At LBMC, our mission is to support entrepreneurial businesses at every stage to go further. Building a robust accounting infrastructure is a foundational element of that. That’s why our outsourced accounting services are set up to provide firms with the exact level of support they need. Many outsourced accounting service providers offer completely bespoke packages to their clients. You’ll have the ability to add supplemental services as the needs of your business change.

In doing so, they unlock new avenues for growth and innovation, marking a bold step forward in the evolution of modern business practices. Accuracy in bookkeeping is non-negotiable, given its implications for financial analysis, decision-making, and legal compliance. This precision is crucial for maintaining the integrity of financial reporting and avoiding potential fines or legal issues. With how is sales tax calculated outsourced accounting, your in-house team will not only be freed from the time spent overseeing financial functions.

An outsourced CFO should be a trusted strategic partner with whom you work intimately – not just another vendor. Many businesses work with an outsourced CFO on a short-term project basis, although longer-term, ongoing advisory relationships are also common. These tasks are more strategic in nature than the work typically performed by bookkeepers. These are all expenses that go into hiring an employee, and if you want to run accounting entirely in-house, it’s likely you’ll need more than one team member. We would love to talk to you about how partnering with BAS & More to manage your bookkeeping function can support your business.

Beyond this, having a clean, organized financial infrastructure makes things significantly easier for your business come tax season. If you’re aiming to raise additional funding or are targeting a potential exit, well-organized financial record-keeping will significantly streamline the due diligence process. Outsourcing your bookkeeping tasks can make a significant difference in the day-to-day operations of your business. The staff who previously managed these responsibilities will be free to work on new projects that help to grow the business, resulting in improved morale and productivity. When a business outsources its accounting, it essentially transfers responsibility for some or all of its accounting tasks to https://www.bookstime.com/blog/coronavirus-aid-relief a third-party accounting firm. This is why law firms often neglect their bookkeeping functions, which play a significant role in the financial development of any business.

As a result, enterprises estimate their working capital requirements and commercial banks fund them depending on the duration of the Cash cycle. It shows that a business turns over inventory quickly and collects cash from customers fast. This efficiency boosts the company’s financial performance by improving its liquidity—how easily it can turn assets into cash to use right away. In the dynamic world of business, optimizing operational efficiency is paramount for sustained growth and financial stability.

Next, calculate accounts receivable days by dividing average accounts receivable by net credit sales, followed by multiplying this result by 365. The operating cycle is a critical concept within the realm of business management that reveals how effectively a company transforms its inventory into cash. It encapsulates the journey from purchasing raw materials to collecting revenue from sales, serving as a barometer for assessing the efficacy of a company’s resource and financial management strategies.

Inventory management is a crucial component of your operating cycle, as it directly impacts how efficiently you can turn your investments in goods and materials into cash. By carefully controlling your inventory, you can reduce carrying costs, minimize the risk of obsolescence, and ensure that you have the right products available to meet customer demand. On the other hand, companies that sell products or services that do not have shorter life spans or require less inventory tend to be less efficient in terms of operational processes.

If you’re new to the world of finance or business, the concept http://belarustoday.info/index.php?pid=54066 of an operating cycle might seem a bit puzzling. You might have noticed that businesses talk about their operating cycle differently, depending on their industry or size, adding to the confusion. Remember, your operating cycle is not static; it requires continuous attention and adaptation to changing market conditions. By implementing the strategies outlined in this guide and staying vigilant, you can achieve a more efficient operating cycle, setting your business on the path to financial success. This means that companies can reduce or eliminate slow-moving or obsolete inventory, which in turn reduces the cost and time needed to dispose of these items.

Swift response to market changes, quick adaptation to customer demands, and efficient resource utilization position a business as an industry leader. Although you must understand how to calculate the operating cycle if you want to compare yourself to your competitors, it is also important to understand what it really means for your business. So, to clear up any confusion you might have, let’s break down the operating cycle in simple terms, from what it is to how to calculate it to the operating cycle formula and more.

This adjusting entry enables BDCC to include the interest expense on the January income statement even though the payment has not yet been made. The entry creates a payable that will be reported as a liability on the balance sheet at January 31. Assume Bob https://www.map-craft.com/how-are-slopes-and-inclines-calculated-on-topographic-maps/ operates a bakery and is attempting to determine how well his business is performing. This means that the cycle would begin when he started paying for the commodities, resources, and ingredients used to manufacture various pastries and baked items. His bakery’s operating cycle would not be complete until all of his baked items were sold to consumers and he got payment for his sales.

Operating cycle refers to number of days a company takes in converting its inventories to cash. It equals the time taken in selling inventories (days inventories outstanding) plus the time taken in recovering cash from trade receivables (days sales outstanding). Calculating the inventory period is a key step in understanding http://rsoft.ru/services/profiles/emitents/example_eng.htm a business’s operating cycle. You find the average inventory, then divide it by the cost of goods sold (COGS). Companies strive for a shorter operating cycle because it shows they are doing well with inventory turnover and cash flow management. When a company manages its inventory well, it can sell items quicker and collect payments faster too.

There are five types of adjusting entries as shown in Figure 3.5, each of which will be discussed in the following sections. The company has a negative net operating cycle which shows that the company is effectively using the money of its creditors as working capital. It took the company 36 days on average to sell its inventories and 36.64 days to receive cash from its customers i.e. distributors, etc. but it delayed the payment to its suppliers till the 140th day.

The difference between the two formulas lies in NOC subtracting the accounts payable period. This is done because the NOC is only concerned with the time between paying for inventory to the cash collected from the sale of inventory. The post-closing trial balance is prepared after the closing entries have been posted to the general ledger.

The length of a company’s operating cycle can impact everything from their ability to finance new growth initiatives to the interest rates they’re offered on loans. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

The average threshold rating needed to be 3.5 stars or better to get the highest rating in our research. We turned to popular sites, including Trustpilot, G2 and Capterra, for these customer responses. We also weighted the number of responses, giving higher scores to providers that had at least 300 positive reviews to help reduce bias.

At work, Justice is passionate about helping the team make decisions and connections that propel the business forward. He prioritizes client satisfaction by serving as a medium to facilitate communication to the proper channels making sure every issue is properly addressed. Construction accounting is confusing—it takes time out of The Importance of Construction Bookkeeping For Streamlining Business Operations your day that you could spend making money. By teaming up with us, you don’t have to worry about the accounting and you can rest easy knowing it’s being done right. Our experts assess each contract or project for profitability by comparing project earnings to project expenditures.

Set the parameters and qualifications based on insurance requirements, location and experience. You’re able to then compare vendors side-by-side to make the most educated decision. RedTeam is a company built out of a commercial construction firm, so it understands the needs of a construction company intimately. This is one reason it has received several industry awards, including Software Advice’s 2021 Front Runner award and making Capterra’s Shortlist.

We looked at a total of 22 different metrics across five separate categories to reach our conclusion. Here are some of the categories we used to rank the providers that made the top of the list. Both plans allow you to track income and expenses, send invoices and accept payments and maximize your tax deductions with tagging features for expenses. The system also allows you to scan and organize receipts so that all project expenses are kept in one place. The reporting will enable you to track the profitability of each project so that you can stay ahead of costly mistakes.

With construction bookkeeping services, business owners gain a clearer view of the financial health of their business. Transparent financial records foster trust with stakeholders, including investors, partners, and lenders, by showing that the company is organized and compliant. This transparency is also beneficial when seeking financing or making financial decisions, as it provides a reliable record of the company’s financial situation. These services help allocate expenses like labor, materials, and equipment to specific projects. Without proper job costing, businesses risk underestimating expenses and losing control of their https://blackstarnews.com/detailed-guide-for-the-importance-of-construction-bookkeeping-for-streamlining-business-operations/ finances.

By taking these tasks off your plate, you have more time to spend in the field focusing on projects. Partnering on time tracking and project profitability, you will be more prepared to accurately bid projects based on historical information. Managing cash flow will provide a better understanding of where your money is going and coming from, allowing you to make crucial financial and tax decisions. A key aspect of construction bookkeeping is ensuring timely billing for completed work through progress invoicing.

Many devices that we use in our day-to-day life there working principles as gears. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

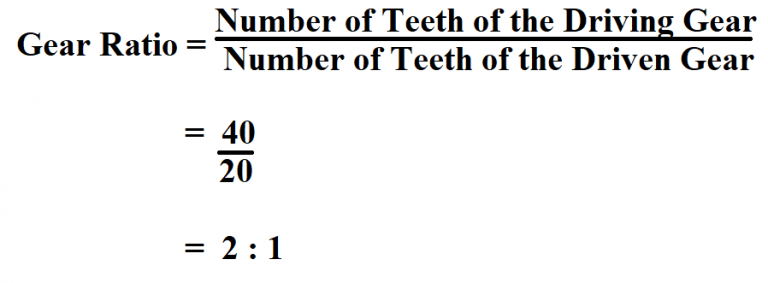

Gear ratios can be used to determine the speed of rotation of a gear set if the input or output speed of the gear set is known. Now by using the gear ratio formula we looked at earlier, we can determine the ratio across the gears. This information can be used to determine the ratio across the entire series of gears. This is considered to be a critical metric to gauge the company’s leverage, as well as financial stability. He assumes the role of CEO and his job is to help the team get their job done.

It’s also important to note that a loss in the business leads to a decrease in overall equity and a decrease in the equity ratio. Similarly, the disposal and acquisition the assets can lead to changes in the equity ratio. The following formula is used to calculate the debt ratio of the business. Many shareholders prefer sourcing capital from debt rather than equity as issuing more shares of stock can dilute their ownership stake in the company.

The par value of shares, anything additional in capital, retained earnings, treasury stock, and any other accumulated comprehensive income all contribute to shareholders’ equity. Gearing focuses on the capital structure of the business – that means the proportion of finance that is provided by debt relative xero soft community to the finance provided by equity (or shareholders). For instance, if the debt ratio is lower, it indicates that debt proceeds have been used to finance the purchase of the assets. In addition, it’s a sign for the lenders that the business has sufficient assets to meet liabilities in liquidation.

Financial institutions and creditors primarily use gearing ratios as they are concerned with the repayment capacity of the firm. Accordingly, they can draft the terms and conditions of the proposed loan. Internal management also uses these ratios to analyze their future profit and cash flows.

There’s a ratio of 54 to 18 or 3 to 1 this means that pinion is turning at three times the speed of the gear. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

In addition, it is also known as financial gearing or financial leverage. However, it is important to note that the definition of good and bad gearing ratios can vary significantly depending on the industry, economic environment, and specific company circumstances. Overall, gearing is considered bad for the business from the financial analysis perspective. For instance, if the business has obtained a loan to finance the project with a higher rate of return, the gearing is good.

It’s a strong measure of financial stability and something an investor should keep an eye on. A gearing ratio is a category of financial ratios that compare company debt relative to financial metrics such as total equity or assets. Investors, lenders, and analysts sometimes use these types of ratios to assess how a company structures itself and the amount of risk involved with its chosen capital structure. The net gearing ratio is the most commonly used gearing ratio in financial markets. The D/E ratio measures how much a company is funded by debt versus how much is financed by equity. Put simply, it compares a company’s total debt obligations to its shareholder equity.

Keep in mind that debt can help a company expand its operations, add new products and services, and ultimately boost profits if invested properly. Conversely, a company that never borrows might be missing out on an opportunity to grow its business by not taking advantage of a cheap form of financing, especially when interest rates are low. Hence, Mr. Raj’s concern is correct, as the firm could end up with the proposed loan for more than 50% of the total assets. ABC has been recently hit by the competition and is looking for a loan from the bank. However, the bank has decided that its gearing ratio should be more than 4. Otherwise, ABC will be forced to either provide a guarantor or mortgage any property.

In practice, many companies operate successfully with a higher leverage and gearing ratio than this, but 50% is nonetheless a helpful benchmark. Financial gearing, or leverage, is the use of debt–as opposed to equity–for the purpose of business financing, with the aim that the return generated will exceed the borrowing costs. Even a slight decrease in the Return On Capital Employed (ROCE) ratio of a highly geared company can cause a large reduction in its Return On Equity (ROE). The gearing level is arrived at by expressing the capital with fixed return (CWFR) as a percentage of capital employed. By contrast, both preference shareholders and long-term lenders are paid a fixed rate of return regardless of the level of the company’s profits.

So it’s not just a nice-to-have in your financial arsenal—it’s a necessity. Check out open roles and be part of the team driving the future of FP&A. Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

It’s especially useful for predicting the resources needed to handle upcoming projects and expenses. When you can quickly create sales forecasts, you can adapt to sudden storms. Leverage the percentage of sales method to get a clear vision of your financial future so you can map strategies that work. Another key advantage of the percentage of sales method is that it helps develop high-quality estimates for items closely correlated with sales. In this step, businesses hope to obtain positive percentages in all accounts.

Businesses can how to log in as an accountant determine how much (approximately) they can earn or lose in all accounts by taking the revenue percentage relevant to every account and applying it to the forecast number. To determine her forecasted sales, she would use the following equation. With a revenue of $60,000, she’s not running a corporation, but she should still expect to run into a small amount of bad debt expense. By looking over her records, she finds that for the month, her credit purchases come to $55,000 (with $5,000 cash).

Multiplying the forecasted accounts receivable with the historical collection patterns will predict how much is expected to be collected in that time period. So it’s not a perfect metric, but for those businesses that use it, the percentage-of-sales method can be a useful predictor of future sales revenue. There are several advantages to using the percentage-of-sales method. First, it is a quick and easy way to develop a forecast within a short period of time.

Once she has the specific accounts she wants to keep tabs on, she has to find how they stack up to her overall sales figures. Well, one of the more popular, efficient ways to approach the situation would be measures of financial leverage to employ something known as the percent of sales method. This method is seen as more reliable because it breaks down the probability of BDE by the length of time past-due. There is a lower chance that recent purchases won’t be settled by the credit card companies than purchases over a month out. This allows for a more precise understanding of what money may be lost. The company then uses the results of this method to make adjustments for the future based on their financial outlook.

Especially when it comes to creating a budgeted set of financial statements. For example, if the CGS ratio increased to 65 percent next year, management would have to examine why their production costs are increasing relative to sales. This could happen because of a number of supply issues or environmental changes. Material prices or utility rates could have gone up uncontrollably during the year for example. One of your goals as a business owner is to increase your sales percentage to grow your business and stay competitive. Adopting smart strategies can improve your sales performance and boost your revenue.

The percentage-of-sales method is used to develop a budgeted set of financial statements. Each historical expense is converted into a percentage of net sales, and these percentages are then applied to the forecasted sales level in the budget period. For example, if the historical cost of goods sold as a percentage of sales has been 42%, then the same percentage is applied to the forecasted sales level.

Let’s take a closer look at what the method is, how to use it, and some of its benefits and shortcomings. From sales funnel facts to sales email figures, here are the sales statistics that will help you grow leads and close deals.

But two years after setting up their Lady of the Château business, the couple say they have been set back by the staggering cost to renovate the sprawling 14,000 square feet property. Harris said Trump “started out with $400 million on a silver platter and then filed for bankruptcy six times”. What Harris said about six bankruptcies is accurate, but she took some liberties with what is known about Trump’s inheritance from his father, real estate developer Fred Trump. “You know, not everybody started out with $400m on a silver platter and then filed for bankruptcy six times,” Harris said. The union said the two sides are scheduled to meet with federal mediators next week for a “last-ditch” effort to get a deal done, adding that flight attendants were told to prepare for a strike. “We have made progress in a number of key areas, but there is still a good deal of work to be done,” Isom said in a video message to flight attendants.

As your company grows in scope and size, it also grows in complexity—which can be hard for any founder to navigate. Yet it’s likely that the scaling challenges your company is facing aren’t unique to you and your business. One involved “ground lease payments”, a financial strategy in which Fred Trump built apartment buildings, then set up lease http://worldofwargaming.ru/world_of_tanks/hitzone/_p=2007.html agreements for the land under these buildings. The beneficiaries of those lease agreements were Fred Trump’s children — eventually five, including Donald — through a trust. Fred Trump set up ground leases for two of his developments in Brooklyn, the first of which became active when Donald Trump was three years old, the Times reported.

Large corporations usually have change leaders in place to determine practical plans and execute systematic implementation. Predicting the pace of your company’s adaptation to change will require an in-depth understanding http://linki.net.ua/page/178 of your team. Sometimes, the best way is to consult and negotiate with your staff on your plans to scale. These forecasts will help you determine the timing of distributions from your internal or investment growth fund.

As a result, your business scales in a manageable way, allowing margins to increase slowly over time. And if you experience a dip in clientele, your revenue is still enough to sustain your workforce and resource costs. Creating a scaling plan allows you to prepare for potential customers and future business opportunities, ensuring sustainable growth in your company.

As you implement the plan, your finance team should monitor your progress continuously against the forecast and make necessary adjustments. You may need to hire managers to oversee employees while you focus on the big picture. Consider working with mentors who https://santamariadelpueblito.org/san-portada-misaportelevision.htm can guide you through this process. Small business loans are one of the most common types of business financing for scaling a business. Yes, you’ll be taking on debt, but many businesses find they need debt to see the growth in revenues that they’re after.

Accounting firms deal with sensitive financial data, and any breach could result in severe financial and reputational damage. Therefore, it’s essential to implement robust security measures that protect this data while complying with industry standards like GDPR or CCPA. However, while the adoption of AI offers numerous advantages, businesses must also navigate potential challenges. Implementing AI in accounting requires careful planning, especially around data management and security. Additionally, firms may face obstacles such as initial setup costs, the need for specialized skills, and concerns about job displacement due to automation.

As firms towards the future, the opportunities are boundless, and the future of accounting shines bright with the promise of AI. This suite of tools aids in data analysis, enhancing the quality of insights provided to clients. By leveraging AI, KPMG is not just crunching numbers; it’s offering predictive insights, identifying trends, and providing strategic guidance that goes beyond traditional accounting.

This, in turn, can help the profession tackle pressing challenges related to production capacity, staffing shortages, and accountant burnout. Key areas of focus and questions to ask as the board helps management prepare for the challenges and opportunities presented by GenAI. By submitting, you agree that KPMG LLP may process any personal information you provide pursuant to KPMG LLP’s Privacy Statement. The AI leaders in our survey plan to increase AI budgets by 25 percent next year and book value vs market value of equity 28 percent over three years.

A workaround is to either keep a human in the loop to verify the accuracy of AI responses or to make the AI double-check itself to reduce the amount of error to negligible. Developing a custom-made AI model with additional functionality would accomplish the latter. Even if based on a generic AI platform, a custom model can demonstrate superior performance in terms of accuracy, efficiency, and security. However, integrating AI in accounting processes comes with a number of challenges and caveats. A GenAI-based bot can provide an accurate, yet simply worded response whenever someone has a question for your accounting department. The widespread belief that AI can easily replace accounting professionals originated from a 2013 study by Oxford University and Deloitte that estimated the probability of job computerization for accountants and auditors at 94%.

The future of AI for accountants should spark plenty of excitement for finance teams. This is an incredible competitive advantage over firms that are resistant to embracing new technology in the accounting profession. With its potential to increase productivity in every sector of the accounting industry, the adoption of AI in accounting is expected to accelerate in the coming years.

Tasks that require critical judgment, experience, and building rapport with clients will continue to depend on human professionals. However, missing out on the opportunities provided by generative AI might not be the wisest course of action. Instead, you may want to consider custom-made AI software that combines the benefits of generative AI with enhanced security to keep your accounting data safe. When an experiment pitted ChatGPT against accounting students solving conversational exam problems, ChatGPT scored a meager 47%, while the humans averaged 77%. The researchers interpreted the AI’s mediocre result as a byproduct of it being essentially a predictive tool. Among all the possible answers to a problem, ChatGPT would lean towards the one that was most frequently used in a variety of contexts across its training data set.

However, while GenAI can jump-start accounting and financial reporting processes, it still requires a driver at the wheel. Since GenAI can be inaccurate and miss nuance, experienced professionals must oversee and evaluate outcomes. Professionals may also require training to formulate effective GenAI prompts and guide it to perform a task. It is also important to continuously monitor and refine AI systems to ensure optimal performance. Staying updated on emerging trends in AI, such as real-time reporting, blockchain integration, and AI-powered financial advisory services, will help businesses stay competitive in a rapidly evolving landscape. Partnering with experts, such as Prismetric, the best AI development company in Australia, can further support businesses in smoothly navigating this transition.

Discover types of accounting, skills, salaries in different jobs, qualifications, and certifications, as well as the steps to getting started. Accounting is by far one of the most important and prevalent fields in the world today. Its use in organizing business transactions and meeting regulatory requirements makes it a field that requires extensive knowledge and study. As such, accountants make strong salaries and work in a variety of industries. At larger companies, there might be sizable finance departments guided by a unified accounting manual with dozens of employees.

Expanding advisory and consulting services requires firms to move beyond a compliance mindset and empower professionals to make decisions and add value for clients. A significant contributor to accounting firm success is the right employees. A big challenge for accounting firms is recruiting and retaining good employees. Recruiting and retaining the right staff has never been more critical for success and it’s also never been more challenging. For example, the changing demographics and the need to appeal to the younger generation.

Examine your firm’s carbon footprint and seriously consider becoming a carbon neutral accounting firm. Sign up to get B Corp certified and identify ways your firm can move forward supporting a future for everyone. Not only are you fighting climate change, but you’re a more attractive option to potential clients and employees.

Offering a competitive salary is also key to attracting and retaining quality employees. Keeping up with legislative changes can be difficult, but there how many types of account in bank are ways to automate many time-consuming tasks, so more focus can be on tasks like these that are very important for your firm and your clients. The CFE credential is recognized and respected by businesses, governments, and law enforcement agencies worldwide.

Just as managerial accounting helps businesses make management decisions, cost accounting helps businesses make decisions about costing. Essentially, logins 2021 cost accounting considers all of the costs related to producing a product. The Alliance for Responsible Professional Licensing (ARPL) was formed in August 2019 in response to a series of state deregulatory proposals making the requirements to become a CPA more lenient. The ARPL is a coalition of various advanced professional groups including engineers, accountants, and architects.

When given the choice, an overwhelming majority of employees—87% according to this study by McKinsey & Company—prefer to work remotely. Right now, 87% of surveyed consumers in the US support mandatory climate disclosures for businesses, with carbon emissions the core focus. By the same token, it’s important to be mindful of the challenges that come with remote work and take appropriate action to mitigate them. A recent Zapier study found that 90% of no-code users believe their company has achieved faster growth because of no-code tool adoption. Technology allows you to always be present—a gift that lets you quickly build strong relationships with your clients.

Forensic accounting is a growing and high-demand field because of the rise in fraud and increasing financial regulations. They use their skills in accounting and investigation to gather evidence and build cases against individuals or organizations accused of wrongdoing. Forensic accountants may also be involved in testifying in court as expert witnesses. The first step to becoming an accounting information systems professional is to earn a bachelor’s degree. While no specific majors will qualify you for this position, you should look for a program that includes courses in accounting, business, computer science, and information systems.

The trend of technology, especially in accounting, is here to stay, so your firm must be well-positioned to handle all of the changes in the future. The accounting profession is quickly adapting to new technologies, such as artificial intelligence to remain competitive. expected return and variance for a two asset portfolio Just as the workforce is changing, so are your clients as the next generation are business owners and need accountants who know what they’re looking for.

The process extends beyond the initial recording, embracing subsequent adjustments for returns, allowances, or discounts, each mirrored through distinct journal entries, and concludes with the final payment. The invoices can include purchases for inventory, office supplies, services received, and so on. Let’s not waste any time and jump directly into the recording procedure for the Accounts Payable journal entry, as mentioned in the introduction accounts payable occur when we purchase something on credit. If your supplier has determined that you are a credible customer, you may receive early payment discounts on your accounts payable. This means while you’re receiving a discount on your accounts payable, you can give a discount on your accounts receivable to customers that make early payments. Ensuring that accounts payable are paid on time will help strengthen your company’s relationship with your suppliers.

As a result, the suppliers would provide goods or services without any interruption. Also, an efficient accounts payable management process prevents fraud, overdue charges, and better cash flow management. Further, it also ensures proper invoice tracking and avoiding duplicate payment.

These entries ensure that the liabilities incurred by the company are accurately reflected in the financial statements, which is crucial for maintaining a clear view of the company’s financial health. Ltd makes a payment of $ 30,000 to its suppliers to reduce the payable liability. With the net improvements to employee leave in nz payroll method, if you pay your supplier within the agreed-upon time period, you’ll get a certain percentage of the discount.

In return, the suppliers will likely offer attractive discounts so that you can save more and stay connected with the supplier. You can calculate the accounts payable by generating accounts payable aging summary report, if you are using QuickBooks Online Accounting Software. This report provides a summary of all the accounts payable balances, and also lets you know about the balances that are overdue for payment. Accounts payable turnover refers to the ratio which measures the speed at which your business makes payments to its creditors and suppliers, indicating the short-term liquidity of your business. It reflects the number of times your business has made payments to its suppliers in a specific period of time, signifying your businesses efficiency in meeting short-term obligations and making payments to suppliers. If your vendors create and send invoices using an invoicing software, then the invoice details will get uploaded to your accounting software automatically.

Similarly, a supplier might grant allowances for damaged goods instead of a return. In such cases, the accounts payable balance needs to be adjusted to reflect these transactions accurately. These journal entries, rooted in the foundational principles of double-entry accounting, provide a transparent record of every financial interaction with creditors.

Likewise, the company can make the accounts payable journal entry by debiting the asset or expense account based on the type of goods it purchases and crediting the accounts payable. To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and credits the accounts payable account. The debit amount is the purchase cost, whereas the credit amount represents the obligation to make the supplier.

Whenever a business purchases inventory, raw material, or other supplies on credit, a transaction can be recorded for the AP account. The accounts payable turnover refers to a ratio that measures how quickly your business makes payment to its suppliers. That is, it indicates the number of times your business makes payments to its suppliers in a specific period of time. Thus, the accounts payable turnover ratio demonstrates your business’s efficiency in meeting its short-term debt obligations. Further, the clerk undertakes the processing, verifying, and reconciling the invoices.

For the purchase of goods, debit the Purchases account and credit the liability account (Accounts Payable). This liability is recorded by debiting the expense or asset account while crediting the Accounts Payable account. The process begins with a credit transaction, giving rise to an accounts payable liability. However, trades payable refers to the mantra synonym obligations for purchases made for direct trade costs such as inventory and raw material. If the buyer maintains a purchases returns and allowances journal, then the goods returned by him would be recorded in that journal, rather than in the general journal. Such entries help in keeping a continuous record of the money or cash that remains with the business after meeting all current obligations, which may be utilized for purposes within the business operations.

Accounts payable (also known as creditors) are balances of money owed to other individuals, firms or companies. These are short term obligations which arise when a sole proprietor, firm or company purchases goods or services on account. Accounts payable usually appear as the first item in the current liabilities section of a company’s balance sheet.