Many devices that we use in our day-to-day life there working principles as gears. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

What is a good or bad gearing ratio?

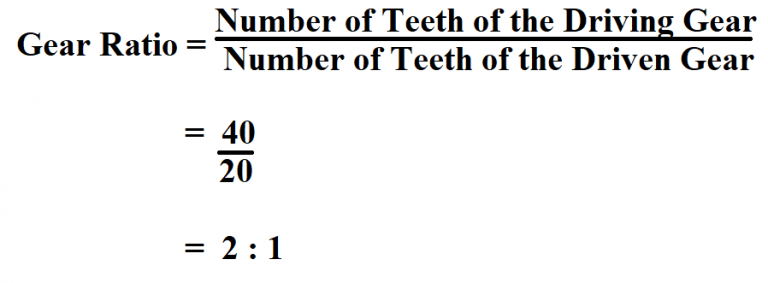

Gear ratios can be used to determine the speed of rotation of a gear set if the input or output speed of the gear set is known. Now by using the gear ratio formula we looked at earlier, we can determine the ratio across the gears. This information can be used to determine the ratio across the entire series of gears. This is considered to be a critical metric to gauge the company’s leverage, as well as financial stability. He assumes the role of CEO and his job is to help the team get their job done.

Planning capital structure

It’s also important to note that a loss in the business leads to a decrease in overall equity and a decrease in the equity ratio. Similarly, the disposal and acquisition the assets can lead to changes in the equity ratio. The following formula is used to calculate the debt ratio of the business. Many shareholders prefer sourcing capital from debt rather than equity as issuing more shares of stock can dilute their ownership stake in the company.

What is the approximate value of your cash savings and other investments?

The par value of shares, anything additional in capital, retained earnings, treasury stock, and any other accumulated comprehensive income all contribute to shareholders’ equity. Gearing focuses on the capital structure of the business – that means the proportion of finance that is provided by debt relative xero soft community to the finance provided by equity (or shareholders). For instance, if the debt ratio is lower, it indicates that debt proceeds have been used to finance the purchase of the assets. In addition, it’s a sign for the lenders that the business has sufficient assets to meet liabilities in liquidation.

- The following information has been taken from the balance sheet of L&M Limited.

- The term refers to the relationship, or ratio, of a business’s debt-to-equity (D/E).

- Gearing Ratios are metrics, and to calculate gearing ratios, different aspects of the company are included.

- When gearing ratio is calculated by dividing total debt by total assets, it is also called debt to equity ratio.

- Please ensure you understand how this product works and whether you can afford to take the high risk of losing money.

Financial institutions and creditors primarily use gearing ratios as they are concerned with the repayment capacity of the firm. Accordingly, they can draft the terms and conditions of the proposed loan. Internal management also uses these ratios to analyze their future profit and cash flows.

There’s a ratio of 54 to 18 or 3 to 1 this means that pinion is turning at three times the speed of the gear. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

In addition, it is also known as financial gearing or financial leverage. However, it is important to note that the definition of good and bad gearing ratios can vary significantly depending on the industry, economic environment, and specific company circumstances. Overall, gearing is considered bad for the business from the financial analysis perspective. For instance, if the business has obtained a loan to finance the project with a higher rate of return, the gearing is good.

It’s a strong measure of financial stability and something an investor should keep an eye on. A gearing ratio is a category of financial ratios that compare company debt relative to financial metrics such as total equity or assets. Investors, lenders, and analysts sometimes use these types of ratios to assess how a company structures itself and the amount of risk involved with its chosen capital structure. The net gearing ratio is the most commonly used gearing ratio in financial markets. The D/E ratio measures how much a company is funded by debt versus how much is financed by equity. Put simply, it compares a company’s total debt obligations to its shareholder equity.

Keep in mind that debt can help a company expand its operations, add new products and services, and ultimately boost profits if invested properly. Conversely, a company that never borrows might be missing out on an opportunity to grow its business by not taking advantage of a cheap form of financing, especially when interest rates are low. Hence, Mr. Raj’s concern is correct, as the firm could end up with the proposed loan for more than 50% of the total assets. ABC has been recently hit by the competition and is looking for a loan from the bank. However, the bank has decided that its gearing ratio should be more than 4. Otherwise, ABC will be forced to either provide a guarantor or mortgage any property.

In practice, many companies operate successfully with a higher leverage and gearing ratio than this, but 50% is nonetheless a helpful benchmark. Financial gearing, or leverage, is the use of debt–as opposed to equity–for the purpose of business financing, with the aim that the return generated will exceed the borrowing costs. Even a slight decrease in the Return On Capital Employed (ROCE) ratio of a highly geared company can cause a large reduction in its Return On Equity (ROE). The gearing level is arrived at by expressing the capital with fixed return (CWFR) as a percentage of capital employed. By contrast, both preference shareholders and long-term lenders are paid a fixed rate of return regardless of the level of the company’s profits.